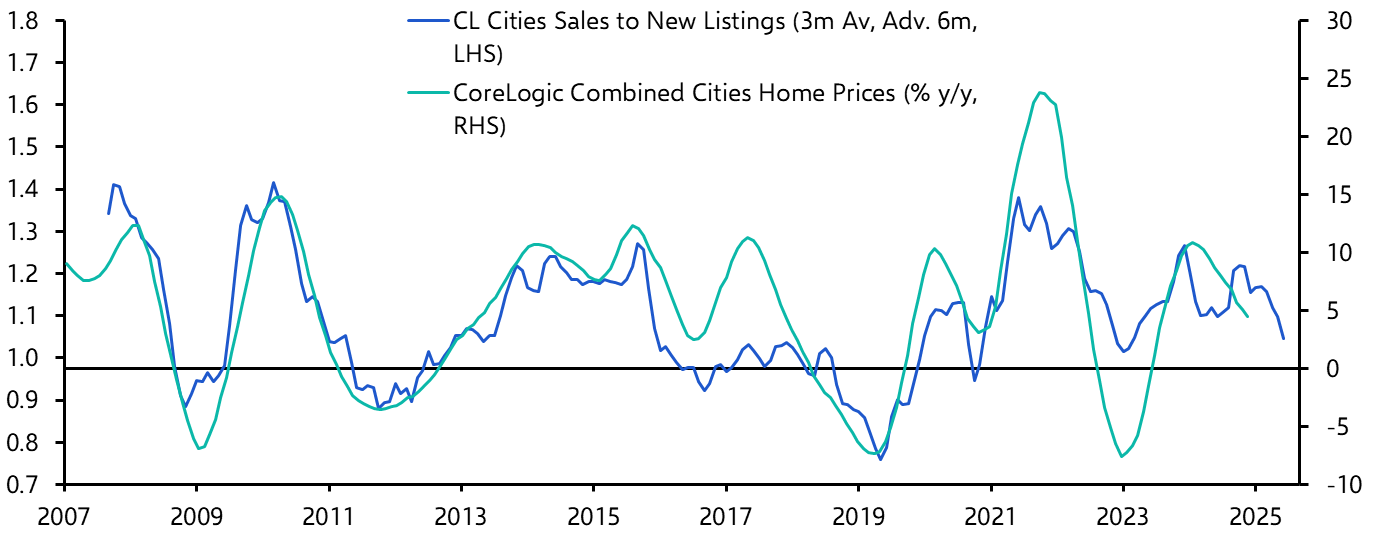

As we move into 2025, the Australian property landscape continues to evolve amid economic shifts and persistent supply challenges. With national home values already climbing steadily—up 0.7% in August alone, marking the seventh straight monthly increase—the stage is set for further gains. This momentum reflects a classic seller’s market, where low listings and strong demand are pushing prices upward. For buyers, sellers, and investors alike, understanding these dynamics is crucial. In this article, we’ll explore the key drivers, regional forecasts, and practical advice to navigate what promises to be a competitive year in the Australian Housing Market 2025.

Key Factors Driving the Australian Housing Market 2025

Several interconnected elements are fueling the anticipated rise in house prices this year. First and foremost, interest rates play a pivotal role. Experts predict gradual cuts starting in the second quarter, potentially dropping from the current 4.35% to around 3.6% by 2026. These reductions are expected to boost buyer confidence and stimulate demand, particularly after a period of caution due to high borrowing costs.

Supply constraints remain a core issue. Despite a 23% increase in house building approvals since March 2024, the pipeline for new dwellings lags behind demand. KPMG’s latest report highlights a shortfall of about 95,000 homes between 2023 and 2026, as population growth—projected at 1.5% for the financial year—continues to outpace construction. This imbalance is exacerbated by moderating construction costs, which rose just 1.4% in the third quarter of 2024, yet overall prices are still 35% higher post-pandemic.

Affordability challenges persist, with high rental costs (expected to grow 3-4% annually) pushing more people toward ownership. Investor sentiment is rebounding, as evidenced by the Melbourne Institute–Westpac Index reaching its highest level since early 2022. Government initiatives, like the expanded First Homebuyer Guarantee offering unlimited places and 5% deposits without mortgage insurance from October 1, are set to inject further activity. However, experts warn that in a low-supply environment, this could accelerate price growth, potentially straining future buyers.

Migration trends add another layer. Net overseas migration, though declining to 261,500 in FY25, still supports demand in major cities. A resilient job market, with unemployment at 4.0%, helps mitigate mortgage stress, though arrears are ticking up slightly to 0.8% for owner-occupiers. Overall, these factors point to a market where sellers hold the advantage, with listings 20% below seasonal averages.

City-by-City Price Forecasts for 2025

Looking across the capitals, growth projections vary, reflecting local economic conditions and affordability levels. According to KPMG data, national house prices are forecast to rise 3.3% in 2025, with units outpacing at 4.6% due to their relative affordability. Perth leads with 4.0% house price growth, bolstered by a strong mining sector and government spending. Melbourne and Canberra follow at 3.5%, with Melbourne’s recovery aided by interstate migration and improved affordability compared to Sydney.

Sydney, the priciest market with medians nearing $1.7 million, is expected to see 3.3% growth despite requiring 68% of average income for mortgage servicing. Brisbane anticipates 3.1%, driven by Olympic preparations and infrastructure boosts. Adelaide’s 2.0% reflects balanced supply increases, while Hobart (1.8%) and Darwin (1.2%) show more modest gains.

Alternative forecasts from Domain suggest even stronger performances in some areas: Adelaide at 12% for houses, Brisbane and Perth at 5-7%, though Melbourne stays flat at 0%. Units in Brisbane and Perth could surge 12%, highlighting a shift toward denser living. Nationally, the market is approaching $12 trillion in value, with recent quarterly gains of 2.2% signaling building momentum.

Strategies for Buyers and Sellers in a Rising Market

For sellers, the current conditions offer a prime opportunity. With competition fierce—evident in Brisbane auctions drawing 15 bidders and Sydney properties fetching premiums. The focus should be on timing listings for spring or post-rate cut periods to maximize returns. Enhancing property appeal through minor renovations can yield significant uplifts, especially in high-demand suburbs.

Buyers face tougher terrain but aren’t without options. First-timers should leverage government schemes to enter sooner. While investors might target units in growth hotspots like Perth or Brisbane for better yields. Pre-approvals and flexibility in location can help secure deals amid low stock.

Monitoring economic indicators, such as wage growth and rental vacancies (currently at 1.6%), will be key. While risks like delayed rate cuts exist, the overall outlook favors steady appreciation.

In summary, the Australian Housing Market 2025 is poised for growth, driven by supply shortages and easing rates. Whether buying or selling, staying informed on these trends will help capitalize on opportunities in this dynamic environment.